Understanding Real Estate Investment Trusts (REITs)

Mar 19, 2024 By Susan Kelly

Real Estate Investment Trusts, or REITs as they are commonly known, wield significant influence in the finance domain. These investment vehicles afford individuals the chance to inject their funds into real estate without assuming direct ownership of properties. Consequently, comprehending the nature and operation of REITs becomes imperative for anyone keen on diversifying his/her investment portfolio. The article delves into the fundamentals of Real Estate Investment Trusts (REITs), their structure, various types, advantages, and hazards while also examining their influence on investors and the broader real estate market.

1. Structure of REITs

Investment vehicles, known as REITs, function under a unique structure that specific regulations govern. Their tax treatment constitutes one crucial aspect of this framework. To qualify as a REIT, the company necessitates distributing at least 90% of its taxable income annually to shareholders in dividend form. REITs, in adherence to this requirement, achieve maximum returns for investors by circumventing federal-level corporate income taxes. A stipulation mandates that at least 75% of their total assets must be invested into real estate, cash, or U.S. Treasuries, a provision that guarantees primacy towards real estate investments.

Moreover, the structure of REITs enables individual investors to easily access real estate markets. Traditional real estate investments often demand substantial capital and expertise. However, investing in REITs offers a more accessible pathway. On stock exchanges, investors can buy and sell shares of publicly traded REITs. This provision brings liquidity and flexibility into the management process for their investment portfolios.

- Tax Benefits: REITs are exempt from corporate income taxes at the federal level, provided they distribute a significant portion of their income to shareholders.

- Accessibility: Investing in REITs provides individual investors with easy access to real estate markets without the need for substantial capital or expertise.

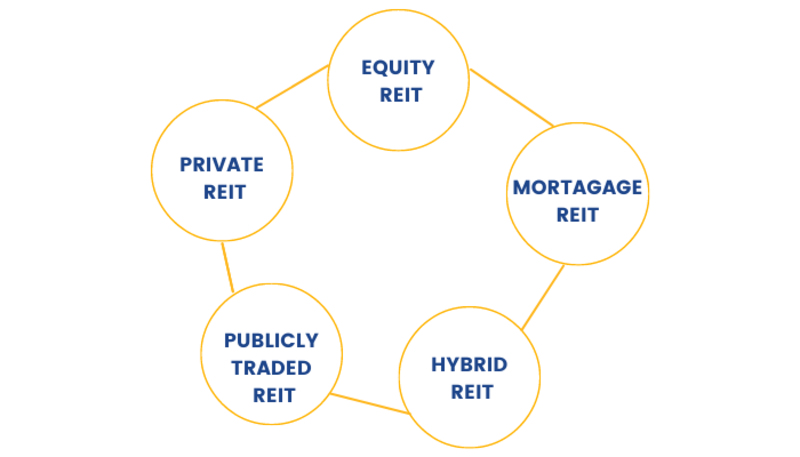

2. Types of REITs

Crucially, investors who wish to tailor their investment strategies towards specific real estate sectors must understand the different types of REITs. These include not only common equity, mortgage, and hybrid REITs but also specialized ones that focus on niche markets such as healthcare, hospitality, and infrastructure. Primarily, healthcare REITs invest in medical facilities like hospitals, nursing homes, and assisted living centers. Hospitality Real Estate Investment Trusts (REITs) concentrate their investments on hotels, resorts, and leisure properties. However, Infrastructure REITs prioritize essential infrastructure assets such as communication towers, transportation facilities, and energy infrastructure.

Furthermore, certain Real Estate Investment Trusts (REITs) function as publicly traded partnerships (PTPs), bestowing distinctive tax benefits upon their investors. These PTPs, recognized also as publicly traded partnerships with qualifying income (PTP-QIs), undergo a different taxation process compared to standard REITs. This offers prospective tax advantages for specific investors, especially concerning pass-through income.

- Specialized Markets: Apart from traditional sectors, REITs operate in niche markets such as healthcare, hospitality, and infrastructure, offering diversified investment opportunities.

- Publicly Traded Partnerships: Some REITs operate as publicly traded partnerships, providing potential tax advantages for investors, especially in terms of pass-through income.

3. Benefits of Investing in REITs

Several compelling benefits emerge for investors who choose to invest in REITs and seek exposure within the real estate market. Among these, one significant advantage stands out. The potential for a consistent income through dividend distributions. The law obliges REITs to distribute an extensive portion of their income to shareholders. Thus, attractive dividend yields are produced. REITs' consistent dividend payments. These provide investors with a reliable income stream. As such, they hold particular appeal for income-oriented portfolios, retirement accounts, or income funds, to be specific.

Investors, through their investment in REITs, diversify their portfolios and gain exposure to a wide-ranging portfolio of real estate assets across various sectors and geographic locations. This strategic diversification spreads risk effectively. Consequently, mitigating the impact that market fluctuations can have on overall portfolio performance. Furthermore, other asset classes, such as stocks and bonds, demonstrate a low correlation with REITs. This amplifies the benefits of diversification.

- Steady Income: REITs offer consistent dividend distributions, providing investors with a reliable income stream, particularly suitable for income-oriented portfolios.

- Diversification: Investing in REITs allows for diversification within the real estate sector, spreading risk across different property types and geographic locations.

4. Risks Associated with REIT Investments

While REITs offer attractive benefits, they also come with certain risks that investors should consider. One significant risk is sensitivity to interest rate changes. REITs often rely on debt financing to acquire and operate real estate assets, making them vulnerable to fluctuations in interest rates. Rising interest rates can increase borrowing costs for REITs, potentially impacting profitability and dividend payouts. Additionally, REITs are sensitive to economic conditions and real estate market dynamics. Economic downturns or declines in property values can adversely affect the performance of REITs, leading to lower returns and increased volatility.

Regulatory and tax changes also pose inherent risks to investments in REITs. Alterations in tax laws or regulations, specifically those governing REITs, may directly impact their profitability and distribution requirements. For instance, modifications made towards the tax treatment or eligibility criteria could significantly influence investors' perception of REITs' attractiveness. Market sentiment or investor preferences, in addition to their impact on the performance of REIT stocks, can instigate fluctuations in share prices and dividend yield.

- Interest Rate Sensitivity: REITs are sensitive to changes in interest rates, as they often rely on debt financing for real estate acquisitions.

- Regulatory and Tax Risks: Changes in tax laws or regulations governing REITs can impact their profitability and distribution requirements.

5. Impact of REITs on Investors and the Real Estate Market

Both investors and the broader real estate market experience a profound impact from REITs, which uniquely provide investors with advantages. They grant access to real estate assets at a relatively low capital requirement and high liquidity. Unlike direct investments in real estate, usually demanding substantial capital involvement with illiquid assets, participation in these markets occurs for investors via easily tradable securities when investing in REITs. Real estate investment, with its inherent accessibility, fosters inclusivity and allows investors to diversify their portfolios beyond the conventional asset classes of stocks and bonds.

REITs are a crucial player in the real estate market. They drive property development, finance it, and ensure liquidity. Through equity investments and mortgage financing, two key avenues of capital provision for real estate projects, REITs not only stimulate growth but also expand the sector itself. Furthermore, publicly-traded REITs bolster both market transparency and liquidity by serving as valuation benchmarks while facilitating price discovery. Their presence is indeed significant. Both investors and property owners reap the benefits of this liquidity. It facilitates efficient capital allocation within the real estate market. Moreover, it enables asset monetization which is a crucial advantage.

- Accessibility and Liquidity: Investing in REITs provides investors with access to real estate markets through easily tradable securities, offering liquidity and lower capital requirements compared to direct real estate investments.

- Contribution to Real Estate Market: REITs play a vital role in property development, financing, and liquidity, contributing to the growth and expansion of the real estate sector.

Conclusion

In summary, Real Estate Investment Trusts (REITs) are essential investment vehicles that allow individuals to invest in real estate without direct ownership. Understanding the structure, types, benefits, and risks associated with REIT investments is crucial for making informed investment decisions. Whether seeking income, diversification, or exposure to the real estate market, REITs offer unique opportunities for investors to achieve their financial goals.

Securing Preapproval for a VA Loan

Mar 19, 2024

Discover the intricate, step-by-step process of securing preapproval for a VA loan, a strategy to guarantee a seamless journey towards homeownership.

An Extensive Principal Financial Life Insurance Review 2022

Jan 28, 2024

The Principal is an established player in 17 international financial marketplaces. They have only offered term and universal life insurance nationwide; whole life insurance is still in the works. Term insurance premiums and levels of protection can be tailored to each client by a financial advisor.

Personal Loan Calculator for Home Improvements

Nov 25, 2023

You can use the loan calculator for home upgrades to see what the overall cost of the loan will be, including the interest and monthly payments.

What to Do After You Have Paid Off Your Car Loan

Feb 03, 2024

Congratulations, you have completed the process of paying off your automobile. So what do we do now? After you have paid off your auto loan, there are a few things that you should do, such as checking to see if you have any insurance discounts available, monitoring your credit ratings, and putting whatever funds you have towards a new objective

Balance Transfer Credit Cards: Should You Give Them a Second Chance?

Dec 05, 2023

Earlier, balance transfer credit cards were much more popular. But due to the pandemic of 2019 and other issues, they were unavailable. As we regained, various issuers of credit cards are bringing it back.

What do we mean by a Policy Loan

Nov 28, 2023

The cash value of a person's life insurance policy is used as collateral for a policy loan given by the insurance company. A "life insurance loan" is one common name for this type of loan. While historically, they had cheap interest rates, this is not necessarily the case currently

Choosing the Right Financial Service for Veterans

Mar 19, 2024

Compare the financial services for veterans offered by Veterans First and Veterans United. Decide which institution better aligns with your needs.

Do You Know: What is a Personal Pension?

Feb 28, 2024

Individuals can take charge of their retirement planning by establishing a personal pension. Sometimes referred to as "money purchase pensions" or "defined contributions," these plans have several names. The amount you receive from an annuity is often proportional to the salary you last earned. At the workplace, several companies provide employees with personal pensions.

What is a Condominium?

Feb 13, 2024

A condominium may offer a more affordable entry into the housing market. However, misconceptions concerning condo ownership frequently prevent prospective buyers from considering them. This article will study some of the most widespread money misconceptions about condos.

Lost Your Job Right Before Mortgage? What to do Now?

Dec 28, 2023

What Happens If You Quit Your Job Right Before a Mortgage Closes Purchasing a home is a major life event, but if you lose your job before closing, it may quickly turn into a nightmare.

Understanding Real Estate Investment Trusts (REITs)

Mar 19, 2024

Explore Real Estate Investment Trusts (REITs), their role as investment vehicles, benefits, and how they operate in the finance sector.

Top 7 Tips For Best Way To Save Money On Car Rentals

Dec 17, 2023

The return of the road trip is one of the most notable changes in vacation habits after the COVID-19 pandemic. However, the availability of rental cars may be constrained during times of strong demand. It comes as no surprise that the cost to rent a car is through the roof if you can even locate one to rent. The excellent news is that automobile rentals don't have to eat up your entire travel budget. Whether on a short weekend trip or a month-long vacation across the country, these 10 tips can help you save money on your rental car.