Exploring Better Mortgage and Rocket Mortgage

Mar 19, 2024 By Susan Kelly

Navigating the home loan landscape necessitates a thorough assessment of your options. Better Mortgage and Rocket Mortgage are prominent contenders among the many choices available. Both offer streamlined digital experiences; these aim to simplify the mortgage process. This article delves into the key differences and similarities between Better Mortgage and Rocket Mortgage, enabling you to tailor an informed decision to your specific financial needs.

1. Ease of Application Process

Better Mortgage and Rocket Mortgage boast user-friendly digital platforms, striving to streamline the historically complex mortgage application process. Offering a straightforward online application procedure, Better Mortgage navigates users through each stride with precision and effectiveness. Applicants can upload necessary documents effortlessly. They can also monitor their application's progress in real-time. Rocket Mortgage, too, exemplifies a flawless digital journey. Applicants can finalize their entire mortgage process conveniently from home. E-signature capabilities and instant verification of income and assets are among its features, guaranteeing an efficient application procedure. Opt for either Better Mortgage or Rocket Mortgage. Both promise an experience free from inconvenience, with the primary aim being saving your time and effort.

Both Better Mortgage and Rocket Mortgage offer more than just the convenience of a digital application process. They provide personalized guidance from seasoned loan officers. These experts stand ready to answer your queries, offer assistance, and most importantly, furnish you with tailored advice, all based on an acute understanding of your distinct financial landscape as well as homeownership aspirations.

- Personalized Guidance: Loan officers provide tailored advice and assistance throughout the application process.

- Real-Time Application Tracking: Both lenders offer features for tracking the progress of your application online.

2. Product Offerings

Better Mortgage and Rocket Mortgage offer a diverse range of mortgage options for their product offerings. Specifically, Better Mortgage caters to borrowers with varying financial backgrounds by providing conventional, FHA, VA, and jumbo loans. It further accommodates different financial situations through flexible terms and competitive rates. Conversely, Rocket Mortgage provides not only comparable mortgage products but also additional specialized loan options like USDA loans and refinancing options. Various loan programs are available for borrowers to explore, allowing them to choose the option that aligns most effectively with their homeownership goals and financial preferences.

Both Better Mortgage and Rocket Mortgage, in addition to offering traditional mortgage products, innovate with solutions specifically designed for borrowers' evolving needs. For instance, Rocket Mortgage equips you with tools such as RateShield Approval. Its a feature that secures your interest rate for a maximum of 90 days during home shopping, thus providing peace of mind amidst a fiercely competitive housing market.

- RateShield Approval: Rocket Mortgage offers a feature to lock in your interest rate while shopping for a home.

- Flexible Terms: Better Mortgage provides customizable loan terms to accommodate different financial situations.

3. Interest Rates and Fees

One of the most critical factors to consider when choosing a mortgage lender is the interest rates and associated fees. Better Mortgage and Rocket Mortgage both strive to offer competitive interest rates, helping borrowers secure affordable financing for their homes. Better Mortgage provides transparent pricing, with no lender fees and competitive interest rates. Additionally, Better Mortgage offers the Better Price Guarantee, promising to match or beat any competitor's offer by $1,000. Conversely, Rocket Mortgage offers competitive interest rates and transparent fee structures, ensuring borrowers have a clear understanding of the costs involved upfront. It's essential to compare the interest rates and fees offered by each lender to determine which option offers the most favorable terms for your financial situation.

Furthermore, borrowers must deliberate over factors transcending the primary interest rate. Specifically, they should consider the annual percentage rate (APR), a metric incorporating supplementary expenses, points, broker fees, and particular closing costs. By comprehending the comprehensive cost of borrowing, borrowers can discern wisely informed decisions, circumventing any unexpected revelations in due course.

- Better Price Guarantee: Better Mortgage promises to match or beat any competitor's offer by $1,000.

- Annual Percentage Rate (APR): Consider the APR to understand the full cost of borrowing, including additional fees and charges.

4. Customer Service and Support

In the realm of mortgage lending, reliable customer service can make a significant difference in the overall experience. Better Mortgage and Rocket Mortgage prioritize customer support, offering various channels for assistance and guidance throughout the mortgage process. Better Mortgage provides dedicated mortgage experts who are available to assist borrowers at every step of the journey, ensuring a personalized and supportive experience. Similarly, Rocket Mortgage offers access to knowledgeable mortgage professionals who can answer questions, provide guidance, and address concerns promptly. By evaluating the quality of customer support offered by each lender, borrowers can ensure a smooth and stress-free mortgage experience from start to finish.

Both Better Mortgage and Rocket Mortgage prioritize transparency in their borrower communication. They provide clear, timely updates on application statuses and loan approvals. This commitment is a driving force towards transparency. It not only informs but also empowers borrowers during the lending process.

- Dedicated Mortgage Experts: Better Mortgage provides personalized assistance from dedicated mortgage experts.

- Transparent Communication: Both lenders offer clear and timely updates on application status and loan approvals.

5. Digital Tools and Resources

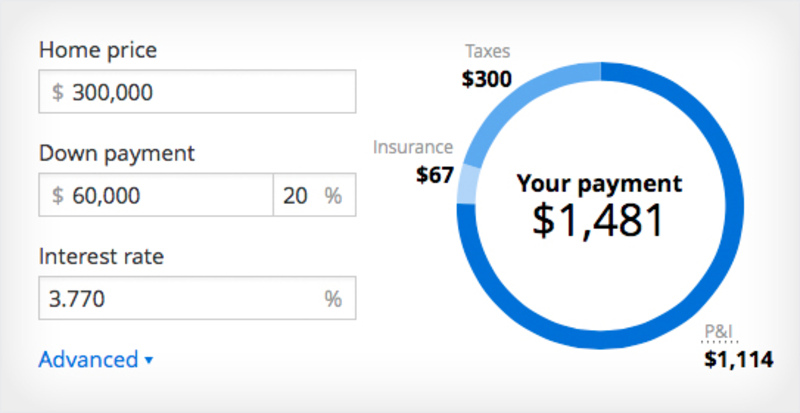

In today's digital age, technology plays a crucial role in the mortgage lending process. Better Mortgage and Rocket Mortgage leverage innovative digital tools and resources to enhance the borrower experience. From online calculators to educational resources, both lenders offer a wealth of digital tools to help borrowers make informed decisions about their home loans. Better Mortgage's online platform features interactive tools to estimate monthly payments, compare loan options, and explore refinancing opportunities. Similarly, Rocket Mortgage offers an array of digital resources, including educational articles and videos to demystify the mortgage process for borrowers. Whether you're exploring mortgage options or tracking the progress of your application, these digital resources can empower you to navigate the mortgage process with confidence.

Both Better Mortgage and Rocket Mortgage also offer mobile applications. These tools enable borrowers to conveniently manage their mortgages while on the move. Document upload features, along with secure messaging options, embedded within these apps not only enhance accessibility but also streamline communication between lenders and borrowers.

- Mobile Applications: Both lenders offer mobile apps for convenient mortgage management on the go.

- Interactive Tools: Better Mortgage provides interactive tools to estimate payments and explore loan options.

Conclusion

As you weigh the pros and cons of Better Mortgage and Rocket Mortgage, it's essential to consider your unique financial situation and homeownership goals. While both lenders offer convenient digital experiences and competitive loan products, subtle differences in interest rates, fees, and customer service could influence your decision. By conducting thorough research and comparing your options carefully, you can select the mortgage lender that best aligns with your needs and preferences. Whether you choose Better Mortgage or Rocket Mortgage, embarking on your homeownership journey is an exciting step toward building a brighter future.

Review Of Flagstar Bank 2023

Dec 09, 2023

Flagstar Bank is a financial institution headquartered in Michigan that provides numerous banking services to its customers. In addition, they offer a mobile app that lets users check balances and make payments on the go. Some customers have praised Flagstar Bank for their excellent customer service and low-interest rates, while others have criticized the bank for its high fees and cumbersome account management.

How To Get a Closed Account Off of Your Credit

Nov 26, 2023

You'll need a good credit score if you want to purchase a house, receive a vehicle loan in your name, or even establish a credit card account. Managing your debts for loans, credit cards, and other forms of credit accounts for a sizable portion of your score. A charge-off occurs when an account becomes seriously overdue, which can devastate a person's credit.

How Can You Get Cash Back on a Credit Card

Feb 04, 2024

Cashback credit cards often provide cash returns at a flat rate or bonus rewards structure. Each purchase with a credit card offering flat-rate cash back will result in the same cash reward.

Navigating Home Equity Loans

Mar 19, 2024

Uncover the best home equity loan options with a Home Equity Loan Finder. Compare loans easily for informed decisions.

How to Assist Your Child in Increasing Their Credit Score

Oct 30, 2023

Excellent credit isn't simply something to boast about; it may open doors for you. If your credit is good, you shouldn't have too much trouble being accepted for a loan, whether that's a credit card, a car loan, a home mortgage, or anything else. In specific industries, having excellent credit is even required for employment. That's why it's a good idea to assist your kid in establishing credit, mainly if he maybe she's a recent college graduate with little to no credit history. Here are a few simple approaches to try. The best ways to get a decent credit score are to make payments on time and keep debt to a minimum. Opening a bank account and demonstrating responsible money management are two ways parents and guardians may help kids become ready to use credit.

How Much Does PODS Moving and Storage Cost

Jan 11, 2024

For your upcoming move, have you considered hiring a moving PODS container? If so, you'll save a lot of money compared to hiring a professional moving company. Renting a transportable moving container from PODS will cost you one-fourth of what finding and hiring transport company will, while also providing you with a secure location to keep your valuables while in transit. This page briefly overviews the several container sizes offered, how the well-known moving container company PODS operates, and how much they cost. But first, the fundamentals

How To Get A Student Loan With Low Interest

Oct 03, 2023

Subsidized as well as unsubsidized federal student loans are the most incredible low-interest options for many students. These loans come with reasonable fixed interest rates that are not determined by your credit score and other benefits for borrowers. However, because federal loans have a maximum amount one may borrow, numerous students may turn to private student loans to fill the gap.

Understanding Millennial Homeownership Trends

Mar 19, 2024

Uncover the statistical data on millennial homeowners and homebuyers. Explore this demographic's composition within the housing market.

Why to Take Out a Personal Loan

Jan 02, 2024

The lender will send the money for the loan once you have confirmed that you agree to the terms of the loan and signed the agreement for the loan. Make sure that you use the borrowed money in a responsible manner and for the purpose that it was intended. Try to avoid utilizing the money from the loan on things that aren't necessary or purchases that aren't important.

Personal Loan Calculator for Home Improvements

Nov 25, 2023

You can use the loan calculator for home upgrades to see what the overall cost of the loan will be, including the interest and monthly payments.

All About Interest Rate Trends for Card, Auto, and Mortgage Loans

Feb 03, 2024

Since the Federal Reserve began monitoring it, interest rates on 72-month new auto loans have remained below 6%, reaching a high of 5.63% in the fourth quarter of 2018. For two straight quarters in 2016, the rate stayed at 4.08%. The average interest rate for a 72-month loan on a brand-new vehicle is 5.19% as of the second quarter of 2022

How to Share Car Expenses With Your Partner

Dec 11, 2023

Are you looking for ways to split up the costs of using a car with your partner? Read this guide and discover effective strategies for sharing car expenses effortlessly and equitably.