How to Share Car Expenses With Your Partner

Dec 11, 2023 By Susan Kelly

Do you and your partner often drive together for errands, appointments, or vacations? If so, both of you will likely share the costs of using a car. Whether it's gas money, insurance premiums, repair bills, or fees related to registering your vehicle, taking care of these expenses can be confusing without properly dividing them.

This blog post'll show you how to share car expenses with your partner efficiently and equitably. From developing a budget plan to discussing the best ways to keep records of payments made, read on to learn about different strategies for efficiently splitting up car-related costs!

Brainstorm Ideas to Split Car Expenses With Your Partner

Sharing car expenses with your partner can be a great way to make owning a vehicle easier and more affordable. To ensure that car expenses are split up fairly, you must agree on how much each person is responsible for. Here are some ideas you can use when brainstorming about splitting car expenses:

- Establish a budget and divide the costs based on it. For example, one partner may incur more fuel costs while the other pays more for maintenance and repairs.

- Make a list of all car expenses so that both parties know what to expect from each other. This will help you keep track of how much money needs to be shared by each person.

- Establish a payment plan, such as one partner taking on most of the costs now while the other pays later. This can help ease the financial burden for both of you and make it easier to keep up with payments.

- Review expenses periodically to ensure both parties are comfortable with the arrangement. This can be done quarterly or once a year.

- Consider any special circumstances, such as one partner using the car more often than the other. This can help ensure that both parties get an equitable share of costs and that no one shoulders more of the burden than necessary.

Consider Allocating a Fixed Amount for Car Maintenance and Repair Costs

Sharing car expenses with your partner is an important part of having a successful relationship. It's important to ensure that both partners are on the same page regarding covering costs and that all expenses are accounted for. Here are some tips for how to share car expenses with your partner:

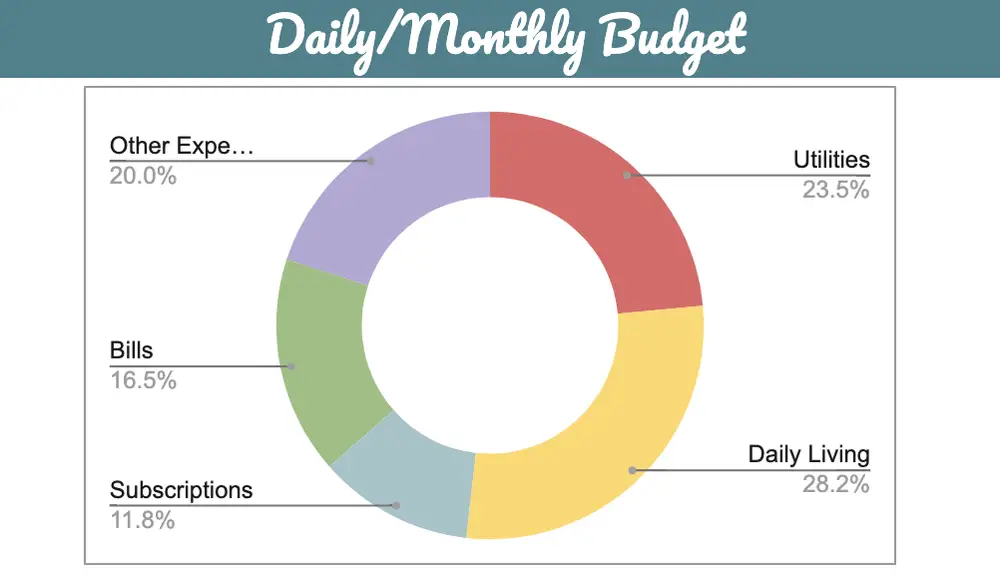

1. Set Up a Budget: The first step in sharing car expenses with your partner is to create a budget. This should include all the costs of owning and operating a car, such as gas, insurance, repairs, and maintenance. Consider establishing a fixed amount that each partner will contribute towards the cost of these items so there are no surprises down the line.

2. Make Sure All Expenses Are Covered: Once you've established a budget, account for all car expenses that may arise. This includes unexpected repairs, maintenance costs, and additional items such as new tires or a replacement battery. Consider setting aside money each month to cover these costs so there are no surprises when they arise.

3. Share Driving Responsibilities: Depending on your living situation, you and your partner may not be able to share the responsibility of driving. Ensuring that all driving-related expenses are shared equally is important in these cases. This includes tolls, parking fees, and any tickets acquired while out and about.

4. Shop Around for Insurance: The cost of car insurance can add up quickly. Shop around and compare different policies to find the best deal for both partners. This will help keep costs down while maintaining adequate coverage in case of an accident or other unexpected event.

5. Consider Allocating a Fixed Amount for Car Maintenance and Repair Costs: One way to ensure that both partners are adequately funded with car expenses is to set aside a fixed amount each month for any car maintenance or repair bills that may arise. This will help keep costs in check and ensure both partners can pay their share of the bill when it's due.

Decide on Who Will Handle Insurance Payments

When it comes to sharing expenses for a car, one of the biggest bills you'll have to pay is car insurance. Car insurance is legally required in all states and covers you and your partner if an accident occurs.

Most couples handle this expense by having one partner responsible for the car insurance payments. However, this isn't a hard-and-fast rule – you and your partner can decide what works best for you. If you're looking to split the cost of car insurance in half, there are a few ways to make it happen.

The first is having each partner take out their car insurance policy. This way, each partner is only paying for the coverage they need, and you're both covered in the event of an accident. This can be a great option if one partner needs more coverage than the other (for example, if one partner has a longer commute).

Create a System to Track Shared Car Mileage

Sharing a car with your partner can be an excellent way to save money, but ensuring both partners contribute fairly is important. Creating a system to track shared car mileage is necessary to ensure that everyone gets their fair share of the expenses.

The first step in setting up this system is for both partners to agree on sharing the expenses. This could mean both partners splitting the cost of car maintenance and insurance, or one partner covering those costs while the other covers gas and parking fees. Once you've agreed on who's paying for what, it's time to set up a system to track shared car mileage.

The easiest way to do this is with a mileage-tracking app or spreadsheet. Apps like MileIQ will automatically track all your trips and log them in an easy-to-read dashboard, while spreadsheets can be created to manually input your trips.

Set Up a Reimbursement Process for Gas Purchases

If you and your partner have decided to share a car, then it's important to make sure that you are both aware of the financial aspects of car ownership. One way to ensure that each person is fairly reimbursed for expenses related to the vehicle is to set up a reimbursement process for gas purchases.

The first step in setting up a reimbursement system is to decide who will pay for the gas. Typically, the person who drives the car is the one who pays for the gas. If you and your partner alternate between driving, it's a good idea to track who drove when so that each person can know how much they need to pay in reimbursement.

Once you have decided who will pay for the gas, you can set up a system to track and reimburse each person. Keep a spreadsheet or use an app like Expensify or QuickBooks. This way, both partners can access an updated summary of expenses related to the car.

FAQs

How should I calculate the amount each of us needs to contribute?

Before sharing car expenses with your partner, it is important to figure out what percentage of the costs each person is responsible for. To do this, determine who will use the car more and assign that person a higher share of the expenses. You can also factor in other considerations, such as income level, who bought the car in the first place, or any other financial contributions each person is making.

What are some of the expenses I should consider when sharing a car with my partner?

When sharing a car with your partner, some costs include gas purchases, registrations and inspections, insurance premiums, parking fees, and major repairs or replacements. Additionally, consider car-related miscellaneous items such as toll fees, car washes, or detailing services.

What is the best way to keep track of shared expenses?

To ensure both parties contribute their fair share and remain on the same page financially, create a spreadsheet or use an app that tracks shared expenses. This will help you accurately record who paid what and when.

Conclusion

This article has helped you navigate the complexities of sharing car expenses with your partner. Although it may seem daunting, following the above steps can help you create an organized and effective system for managing shared car costs.

Sharing expenses can be a great way to save on costs and build trust between partners while maintaining financial independence. With careful planning and open communication, you can ensure that your shared car expenses are reasonable and manageable.

When Purchasing A Vehicle, You Should Be Aware of These 5 Costs

Dec 03, 2023

The expense of driving to work, rather than the cost of housing, generally dominates our monthly budgets. Because of the ever-increasing cost of new cars, consumers constantly search for the best deals. Car dealerships still need to turn a profit, though, and one way they accomplish this is by including several "extras" in the final price that weren't originally disclosed

Top 7 Tips For Best Way To Save Money On Car Rentals

Dec 17, 2023

The return of the road trip is one of the most notable changes in vacation habits after the COVID-19 pandemic. However, the availability of rental cars may be constrained during times of strong demand. It comes as no surprise that the cost to rent a car is through the roof if you can even locate one to rent. The excellent news is that automobile rentals don't have to eat up your entire travel budget. Whether on a short weekend trip or a month-long vacation across the country, these 10 tips can help you save money on your rental car.

Difference Between Gap Insurance And Loan/Lease Payoff

Jan 11, 2024

However, if you get gap insurance during that time frame, the insurer will pay the differential between the ACV and the loan balance if your automobile is totalled. Paying off a loan or lease allows you to buy the automobile anytime, but you'll still be restricted to paying off just a portion of its fair market value. Due to the little risk involved, both forms of coverage are reasonably priced, although businesses more often offer gap insurance. Although it's common knowledge that a brand-new automobile loses value the minute you drive it off the lot, you may not realize that it loses another 10% in value during your first month of ownership and another 20% during your first year.

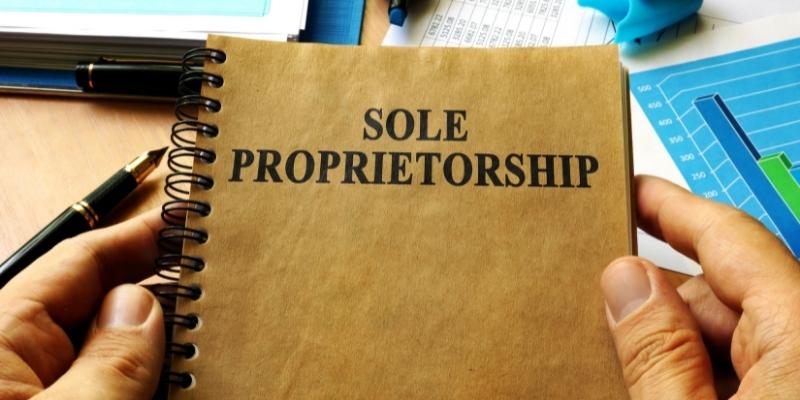

How To Start a Sole Proprietorship in 2022: A Complete Guide

Jan 10, 2024

Business formation is straightforward for sole proprietorships because they are not required to file paperwork with government agencies.

Best Home Based Businesses

Nov 09, 2023

Get started on your journey to financial independence by exploring the best home-based businesses in 2021. Uncover profitable and rewarding options, from selling homemade products to launching an e-commerce store. Learn how you can take control of your future today!

February 2023 Student Loan Interest Rates

Dec 17, 2023

Student loans aren't free but may help bridge the gap when other aid forms fall short. More interest is added to your principal balance. The interest rate influences both your overall debt and your regular payment amount

Everything You Need to Know About Home Equity

Mar 19, 2024

Understand home equity, its definition, and implications. Learn how it works and its significance in personal finance.

Getting Started With Medicare: A Step-by-Step Overview

Oct 08, 2023

When they reach the age of 65, most Americans enroll in Medicare. The Social Security Administration (SSA) manages enrollment. Therefore, you can visit an SSA office or start the process online at SSA.gov. If you miss the deadline to enroll in Medicare, you may incur a late enrollment penalty. To avoid this, it is important to carefully consider the several enrollment options provided below

Understanding TD Bank's Home Equity Offerings

Mar 19, 2024

Uncover TD Bank's home equity options, rates, and requirements. Find out if it's the right choice for your financial needs.

Review of AARP Company

Oct 11, 2023

The American Association of Retired Persons (AARP) oversees several community-based initiatives that aim to combat senior housing instability and social isolation. The AARP has also spearheaded and overseen initiatives to improve entitlement programmes like Medicare and Social Security

How To Get A Student Loan With Low Interest

Oct 03, 2023

Subsidized as well as unsubsidized federal student loans are the most incredible low-interest options for many students. These loans come with reasonable fixed interest rates that are not determined by your credit score and other benefits for borrowers. However, because federal loans have a maximum amount one may borrow, numerous students may turn to private student loans to fill the gap.

What Is Subordinated Debt And What Are the Possible Consequences?

Oct 31, 2023

An unsecured loan or bond with a lower claim priority to assets or earnings is called subordinated debt or a subordinated debenture. Debentures with a lower ranking than equity are categorized as junior securities. In the event of borrower failure, subordinated creditors will get paid after all senior bondholders have been repaid in full.