Marginal Benefit vs. Marginal Cost: What is the Difference?

Aug 24, 2022 By Susan Kelly

Introduction

The idea of marginal benefit and cost goes well beyond economics. This connection is also crucial to government policymaking. Government members are frequently put in the position of weighing the relative marginal benefits of competing public programs. The marginal advantage of increasing transportation subsidies may be less than the benefit of boosting police resources if the crime is high in a particular location.

It is up to elected officials to decide how to spend scarce resources like public dollars, as different initiatives will have varying marginal benefits. The marginal value of directing resources to other initiatives typically outweighs the benefit of focusing on a single issue, even though removing specific problems within a city (i.e., a 0% crime rate) would be possible. In this guide we wil discuss and compare Marginal Benefit vs. Marginal Cost.

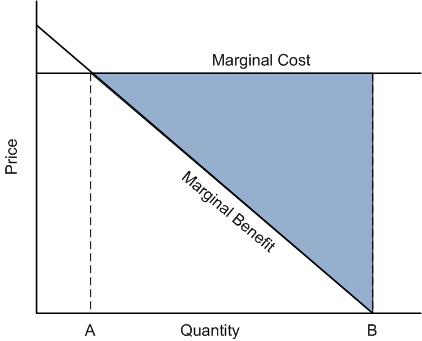

Marginal Benefit

Adding more of a product or service to one's routine might have a slightly positive impact or marginal benefit. More consumption of a single good result in a diminishing marginal benefit. Marginal advantages can also be understood by considering how much more content a customer is after buying more items. The purchaser's happiness level will increase dramatically after purchasing just one ring, but it will not increase dramatically after purchasing a second ring. The marginal utility of an extra unit consumed decreases as its consumption increases. The marginal benefit can be written as the amount of money a buyer is willing to spend on a single transaction in Indian rupees. This is the reasoning behind stores' numerous discounts and sales events.

Marginal Cost

The opposite end of the spectrum is the manufacturer or service provider. The marginal cost, the incremental cost of producing one additional unit relative to the last, is a crucial consideration for manufacturers. Economies of scale allow businesses to reduce their per-unit production costs as they grow their output. Employees should be educated in the art of task switching to maximize productivity. It could help the factory or manufacturing unit produce more of a particular product each hour.

The unit cost of the factory's completed goods decreases as more pairs of shoes are produced simultaneously because the fixed costs are distributed over a wider population. The marginal cost per unit of a good or service may decrease as output increases, thanks to economies of scale. The amount of money you can save with this method is restricted. A factory's output can only go up so much before the workforce and machinery are exhausted. The total cost can only be driven down so far by acquiring materials in bulk. This calls for a new factory and an army of new workers to be hired. A new plant can only be profitable if there is a continuous rise in consumer demand.

How Do You Calculate Marginal Benefit?

To determine marginal benefit, divide the percentage increase or decrease in total benefit by the percentage increase or decrease in the consumption rate. The calculation for the marginal gain can now be made. To illustrate, let's assume that the value of the advantages gained from owning these five sweaters is $200. As a result, it seems that having five sweaters is a good idea. To calculate, divide (220 minutes 200) by (6 plus 5), which is the number of sweaters. If having six sweaters is a net benefit of $220, then having a seventh sweater is a net benefit of $20.

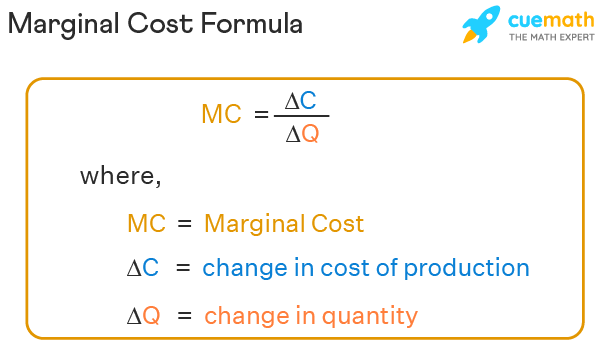

How Do You Calculate Marginal Cost?

You can calculate your marginal cost if you know how many units you're producing and how much they're costing you overall. By doing so, you may calculate the price at the margin. Let's assume the cost to produce 50,000 mobile phone cases is $100,000. If it costs $105,000 to produce the first 55,000 cell phone cases ($105,000 minus $100,000 divided by 55,000), then the marginal cost of making an additional 5,000 cases is $1 per unit (55,000 units minus 50,000 units).

When Does Marginal Profit Equal Marginal Expense?

The market is most efficient when the marginal benefit equals the marginal expense. Producers are making exactly what consumers desire. Therefore there is no overproduction or underutilization of the product. If this degree of efficiency cannot be achieved, it may be necessary to adjust the output of goods.

Conclusion

Often, the gap between marginal gains and marginal costs is considerable. Though complementary, their respective functions make them indispensable to consumer goods manufacturing. They will play a significant role in the near- and medium-term expansion and improvement of the American economy.

Do You Know: What is a Personal Pension?

Individuals can take charge of their retirement planning by establishing a personal pension. Sometimes referred to as "money purchase pensions" or "defined contributions," these plans have several names. The amount you receive from an annuity is often proportional to the salary you last earned. At the workplace, several companies provide employees with personal pensions.

Dec 12, 2022 Triston Martin

Citi Diamond Preferred Credit Card Review 2022 in Detail

The Citi Diamond Preferred Card is now an even better option for balance transfers thanks to its new introductory APR periods, but it is no longer competitive as a general-purpose zero-interest card due to its higher balance transfer fee and shorter introductory purchase APR.

Aug 31, 2022 Triston Martin

What Is A Personal Loan?

If you can get a better deal elsewhere, going with a personal loan may not be the best alternative. However, there are also many compelling arguments in favor of picking them.

Jan 07, 2023 Susan Kelly

What Tax Breaks Can I Get This Year?

Tax credits are reductions in the amount of taxes owed and can provide significant financial benefits. Common tax credits for 2023 include the Child and Dependent Care Tax Credit, Earned Income Tax Credit, American Opportunity Tax Credit, Lifetime Learning Credit, Adoption Tax Credit, Child Tax Credit, and Retirement Savings Contributions Credit. Eligibility for each credit depends on factors such as income, expenses, and family status.

Feb 14, 2023 Triston Martin

Online Shopping: The Benefits and Drawbacks

The growth of the online shopping industry is astounding. The first three months of 2022 saw an estimated $250 billion in online retail spending by Americans, according to figures from the United States Census Bureau..

Sep 13, 2022 Susan Kelly

What to Do After You Have Paid Off Your Car Loan

Congratulations, you have completed the process of paying off your automobile. So what do we do now? After you have paid off your auto loan, there are a few things that you should do, such as checking to see if you have any insurance discounts available, monitoring your credit ratings, and putting whatever funds you have towards a new objective

Jun 09, 2023 Susan Kelly